Acquisition project | Clearmind

Addressing the dire shortage in therapists in India ( 1 therapist per 4lakh in need), Clearmind offers a private and accessible alternative for individuals who might feel intimidated by the cost or stigma of seeking professional help.

Step 1: Understanding Clearmind

Overview

Basic Information | Clearmind's Data Points |

|---|---|

Tech-enabled product/Internet first product | Yes |

Industry Domain | Mental Health, Fitness, Self-care |

Achieved PMF? | No |

Repeat usage of the product | Usage frequency: Medium to High |

Public Interest | High |

Brand recognition | Product Hunt’s 7th Product of the day |

Background

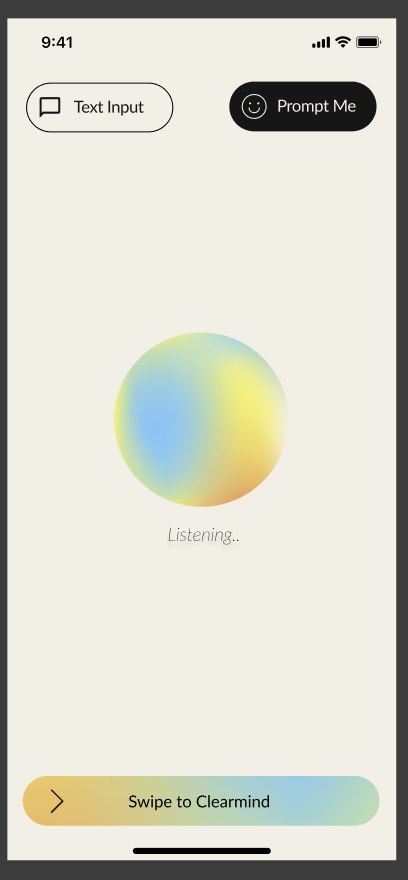

Clearmind is an AI-powered self therapy platform that provides CBT based insights for a positive mindset on daily journal entries, Music & Podcasts recommendations, actionable to-dos and generates real-time, context based meditation to calm the mind.

The mission is to harness AI and use proven techniques to bring a paradigm shift in the way people reflect on their inner selves - similar to how they maintain their physical health - and reduce the number of people that need access to costly and inaccessible traditional therapy methods like 1:1 sessions.

The Clearmind community began taking shape in November 2022. Contrary to popular belief, the conversations with the users on the MVP version revealed the need for a platform where there is no human at the end of the loop to judge raw emotions shared by the users. As a result of a research conducted with 86 users, some even suggested that it is better than traditional therapy.

Anika Beri, the founder, brings ten years of experience as one of India's top clarity coaches, where she utilized spiritual coaching, mindfulness, and community healing methods. These approaches were instrumental in building Clearmind and also acquiring the initial user-base.

Today, the web-based app has over 60,000 users across 106 countries, with Germany, the UK, and Iran being the top countries, and it has plans to expand into the B2B healthcare sector, which has already shown a lot of interest in the product.

What does Clearmind solve for?

Basic Features and Functionalities

- Voice chat in 120+ languages: Dive into insightful chats, discover hidden emotional patterns, and get tailor-made strategies to better your well-being. Our mental health chatbot provides affordable therapy at your fingertips, anytime you need.

- CBT based response: Clearmind's AI is built on Cognitive Behavioural Therapy technique to identify thought patterns in your words overtime, reshape your thinking and help you map your progress in your emotional journey.

- Music and Podcast recommendation: Analyzing your current mood and previous interactions, Clearmind offers a variety of personalised suggestions to brighten your day. The more you converse with it, the better it understands your taste.

- Daily To-do's: It automatically finds your perfect goal, breaks it into easy tasks that promise growth. The cherry on top? You can tick them off in less than a day!

- Personalised meditation: Experience the future of mindfulness with Clearmind's real-time, hyper-personalized meditation. Our scripts adapt to your unique mood and life's narrative, paving your path to inner peace.

Domain Insights

- Personalization of Mental Health Care: The domain benefits from leveraging AI to provide personalized experiences adjusted to individual emotional states. This increases user engagement and effectiveness of interventions by adapting content based on real-time feedback.

- Accessibility of Support: AI mental health apps make access to mental health resources easier, making them available 24/7.

- Data-Driven Insights: These platforms utilize data analytics to offer insights into users' emotional patterns, helping them understand triggers and develop coping strategies. For instance, mood tracking features allow users to visualize their emotional journey over time.

- Integration of Therapeutic Techniques: Many apps incorporate proven therapeutic frameworks such as CBT or mindfulness practices, improving their credibility and effectiveness.

- Ethical Considerations: The use of AI in mental health raises ethical concerns regarding privacy, data security, and the potential for over-reliance on technology. Apps prioritize user data protection through encryption but must continually address these challenges as they evolve.

- Community Support Features: Some platforms allow community engagement by allowing users to share experiences and coping strategies, creating a sense of belonging that can enhance emotional well-being.

Step 2: Understanding the Users

ICP-1 | ICP-2 | ICP-3 | |

|---|---|---|---|

Who are they? | College Student | Working professional | Small business owners |

Age | 18-24 | 25-45 | 24-45 |

Gender | Any | Any | Any |

Location | Tier 1 | Tier 1 | Tier 1 |

Income | >5 LPA | >40 LPA | >8 LPA |

Relationship Status | Single/ In a relationship | Any | Single/ In a relationship |

Lives with | Family, alone | Family, Roommates | Family, Alone |

Where do they spend their money? | Luxury, food, investments, shopping, groceries | Entertainment, food, lifestyle, travel, rent | business, lifestyle, fashion, groceries |

Where do they spend their time? | Weekdays: Office, friends, fitness | Weekdays: College/Internship, projects, friends, commute | Weekdays: building business, friends, fitness |

Which apps do they use frequently? | Swiggy, Zomato, GPay, Instagram, Spotify, Slack, WhatsApp, Notion, chatGPT | Headspace, Instagram, Zepto, Amazon, Myntra, Netflix, WhatsApp | Whatsapp, Instagram, Youtube, Uber |

Money or Time? | Money | Time | Money & Time |

Previous expense on mental well-being throughout the year | >1500/year | >15000/year | >5000/year |

The Problem: How many times in a week do they feel anxious/ stressed? | 12 to 14 times in a week. |

| Everyday, multiple times. |

Need Assessment (Stress levels/Other mental health symptoms) | High | Very High | Very High |

Awareness of mental health products | High | High | High |

Trust in AI | High | Medium | Medium |

Current pain points | -Expensive solutions -Unsure if my problems are real -Family/ social stigma/ fear of judgement | - Generic solutions -Too many opinions, don't know how to start | -Less time to prioritise mental health |

Current solution | -Talking to friends -Physical or creative activities -Articles and blogs | -Talking to friends | -Self healing techniques |

ICP Prioritisation Framework

Value to user | Ease of adoption | Frequency | Appetite to pay | CAC | |

|---|---|---|---|---|---|

ICP 1 | Very High | High | High | Medium | Low |

ICP 2 Professionals | Very High | Low | Medium | High | High |

ICP 3 | High | Medium | High | Medium | Medium |

Therefore, ICP 1 > ICP 2 > ICP 3

User insights via form:

Real Feedback, Real Users

Observations and Conclusions

-Social media and word of mouth are the star acquisition channels

- Payment has been an issue with the current users

- Users love dropping positive feedback after a good experience

- Security and privacy concerns are a thing while using the app

- More multi-lingual requests are seen

- Better and more accurate AI responses will help retain users

- When emotions are reflected back at users, they get more clarity and a 'aha moment'

Step 3: Understanding the Market

Market Size

Since Clearmind is a B2C mental wellness platform, the target customers are people who already take online therapy in some form across various demography and across all genders.

To calculate TAM, SAM, and SOM, we need to:

- Understand the global and India-specific mental health market size.

- Narrow it down to the number of online + AI therapy usage.

- Consider Clearmind's potential market penetration based on competition and market demand.

Total Addressable Market (TAM)

TAM refers to the entire market demand for a product or service, assuming no competition and 100% market coverage.

Key Metrics to Calculate TAM:

- Global Online Therapy Market Size

- Current Market Size (2024): USD 9.68 billion

- Future Projections (2031): USD 24.80 billion

2. AI Therapy or Alternative Growth Market Size - Current Market Size (2023): USD 0.92 billion

- Future Projections (2033): USD 14.89 billion

Total TAM = USD 9.68 billion + USD 0.92 billion = USD 10.60 billion

Key Metrics to Calculate SAM:

- If the TAM for online therapy is USD 10.60 billion, and assuming that busy professionals and students make up about 40% of this market, the SAM would be:

SAM = 40%×USD 10.60 billion= USD 4.24 billion

Key Metrics to Calculate SOM:

- If targeting a 5% capture of the SAM in the initial years post-launch, the SOM would be:

SOM = 5% × USD 4.24 billion = USD 0.212 billion

Competitor Research

App | Key features | USP | Geography | AI Approach |

|---|---|---|---|---|

Clearmind | Mood tracking, personalized meditation | Hyper-personalized emotional support | Global | Fully AI-driven |

Meru Health | Personalized treatment plans, online counseling | Clinically validated treatments | U.S., expanding | AI to adapt treatment plans |

Ginger | On-demand coaching, video sessions | 24/7 accessibility | U.S., global expansion | AI matches users with therapists |

Woebot | CBT techniques via chatbot | Engaging conversational style | Global | Fully AI-driven |

Wysa | Self-help tools, guided meditations | Hybrid model with human access | 95+ countries | AI + Human |

Youper | Emotional health assistant | Insightful emotional engagement | Primarily U.S., expanding | AI as chatbot |

Therabot | Generative AI therapy scripts | Targeting underserved populations | U.S. (in trials) | GenAI |

Key Insights

Conclusion:

- The market is growing exponentially especially in the US and Asia-Pacific regions

- No two companies are using AI for the same reason, hence reducing direct competition while still validating the space.

- Clearmind stands out with its hyper-personalized approach, something that even users appreciate the most.

- Competitors like Wysa and Ginger emphasize hybrid models combining AI with human therapists.

- Understanding local cultural contexts is crucial for maximizing impact, a space where Clearmind is lacking.

- These tools are still meant to complement—not replace—human interaction in therapy settings.

Core Value Prop

Mental Health Care that adapts to your personality.

After a thorough competitive analysis and understanding user feedback, what stood out was the personalisation that no other platform offers yet. This recall value gives Clearmind leverage and ensures it stands out in the competitive market.

Customer Journey

Mind Map Structure for Clearmind's Customer Journey

Choosing a channel for Acquisition

Which to pick? : It is important to understand the product distribution channels before applying growth frameworks to ensure that Clearmind reaches its target audience efficiently and effectively. Without this understanding, the growth strategies may not be successful in driving sustainable growth Clearmind.

Company Stage

Clearmind is in the pre-PMF stage as it is still trying to understand customer needs and validate its product offerings:

1. Problem/ solution fit: It is engaged in Customer Discovery - gathering qualitative feedback from potential users to validate the relevance of their mental health solutions.

2. Iterative product: Still refining product based on feedback

3. Limited market penetration: have low retention rate at the moment

Focus

Acquire users in a faster, cheaper, feedback-driven way.

JTBD

Experiment 1 - SEO (AI Therapist, AIJournal, I feel anxious)

Experiment 2 - Content loops (mental health advocates/ daily bloggers)

Experiment 3 - Product integration (Discovery through therapists and small clinics)

Channel Selection

- As per the recent data on SimilarWeb and Google Analytics, total visitors for our product are coming in from the following channels:

- Competitor traffic from Wysa, Youper, Woebot, thedeepen is also considered.

Search intent > Pull > SEO optimisation

Basis the Google Search volumes results and all other information available using secondary research, the following estimates have been derived:

- 100% traffic from the keyword "ai therapy" is directed towards the landing page

- Thought leadership blogs around anxiety and CBT techniques can further increase visibility

- A combination of low cost to website land, difficulty to rank on SEO would be consider to select which “easy” and “moderate” website to conversion rates can be optimised for.

Example: "cbt therapy bot", "ai mental health", "mental health ai chatbot"

Experiment 1: In-product content loop with Mood Cards

Hook:

Every time the user inputs their feelings, they receive a personalised Mood-Card that acts as a summary of their emotional state. This is directly shareable on all social sites for the friends and family to get a glimpse into the users day-to-day without having to update them.

Generator

In this case, the product is the generator of the content with some help by the user.

Distributor

The user is the distributor of the Moodcard where their social acts as a channel and brings their intrigued followers on the platform.

Experiment 2: Instagram Page focusing on self healing techniques represented graphically

Hook:

- Use colors and patterns to scale content production on Instagram

- 20% platform promotional posts, 80% self-help reels

/

/

Distributor:

The relatable content will be shared with friends and family on Instagram, which acts as a indirect discoverability channel for Clearmind

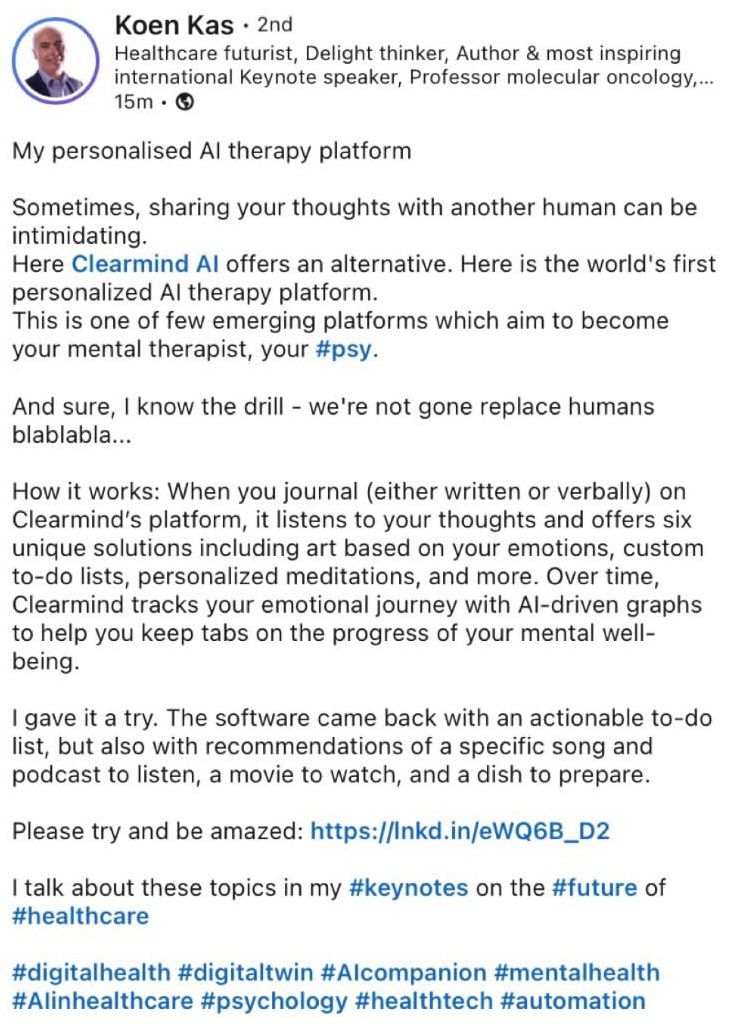

Experiment 3: User-generated SEO Blogs, Videos, Linkedin Posts

Hook:

Since the problem statement is relatable, users, especially life coaches, mentors, etc. establish themselves as social warriors and build their credibility by sharing about the platform to those in need.

Distributor:

The user and their followers share/reshare

Secret weapon: Reviews

Gathering positive feedback to reshare on social media platforms to show the impact Clearmind has already had on users is a great content loop. Here is a PDF of how users see Clearmind:

Not applicable at the moment.

Integrating Clearmind'd API with existing communities

- Grapevine - Founder's community (ICP-3): Integrating Clearmind's bot with limited feature access in communities where queries are answered frequently can be a great acquisition strategy.

Not applicable at the moment.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.